tax credit survey questions

If you earned 72000 or less in 2021 you can file your taxes for free with NYC Free Tax Prep. If a person group or governmental entity does not pay any property tax on a property no one living on that property can claim the credit.

Work Opportunity Tax Credit What Is Wotc Adp

Annual Update of Real Estate Tax Credit for Certain Persons Age 65 and Older Tax year 2021 Senior Circuit Breaker.

. Can the delinquent tax attorneys sell my property for unpaid taxes. Furthermore retail shops say that 30 of their credit card receipts are from outside the. What do I do if one of my jurisdictions on my bill is wrong.

For more information contact MEA regarding Maryland Energy Storage Tax Credit Tax Year 2022 by email at energystoragemeamarylandgovor by phone at 410-537-4000 to speak with Abigail Antonini the MEA program manager. Your project may be eligible for the Program based on its location in a qualified census tract. Title 8 Chapter 5 503 states that all corporations accepting the provisions of the Constitution of this State and coming under Chapter 1 of this title and all corporations which have heretofore filed or may hereafter file a certificate of incorporation under said chapter shall pay to the Secretary of State as an annual franchise tax whichever of the applicable amounts as.

This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and 2006-2010 American Community Surveys. Either census database may be used to evaluate eligibility through a transition period ending October 31 2018. File a 2021 tax return to claim the CTC.

The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. Forms and Instructions Number. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

The minimum term of affordability is thirty years. In fact restaurants in the county report that 60 to 70 of their credit card receipts are from zip codes outside the county. HUD LIHTC Team Regional Points of Contact.

The maximum credit amount for tax year 2021 is 1170. Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Updated Form T2201 and other relevant information.

For questions about filing a renter credit claim contact us at taxindividualincomevermontgov or call 802 828-2865 or 866 828-2865. Compared to a property tax one benefit of a sales tax is that visitors and tourists pay a significant portion of the tax. The Housing Tax Credit Program allocates federal and state tax credits to owners of qualified rental properties who reserve all or a portion of their units for occupancy for low-income tenants.

The Disability Tax Credit DTC Program has been around since 1988 though many Canadians and their medical practitioners still have questions and issues understanding it. TY 2022 Claiming Tax Credit Instructions. 2016 MAP Guide Waivers for Chapter 1413D Repayment Terms for Deferred Developer Fees 03222019.

If the credit youre owed exceeds the amount of the total tax payable for the year youll be refunded the additional amount of the credit without interest. All questions about the RFP must be submitted by February 5th 2021 and all. The Indiana Department of Revenue does not handle property taxes.

MAP Guide 2016 Questions and Answers. IRS-certified VITATCE volunteer preparers are available to help you file. Please direct all questions and form requests to the above agency.

If you rent from a facility that does not pay property taxes you are not eligible for a Property Tax Credit. Upon completing the survey you should receive a confirmation email. According to Section 135010 of the state statutes the Property Tax Credit can only be claimed by a person who lives on or pays rent on a property on which property tax is paid.

Whats driving mortgage rates the week of Aug. However this does not extend the original due date so do not wait to pay your tax bill. Tax Credit Example Calculations.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. That report also included a survey in which a majority of participating employers said applicants. Specifically information on the Disability Tax Credit amounts application process.

The actual credit is based on the amount of real estate taxes or rent paid and total household income taxable and nontaxable. LIHTC Pilot Underwriters September 22 2020. Projects seeking tax credits must have a minimum of 8 tax credit-assisted units.

A mortgage lender credit gives you a break on closing costs but it isnt free money. For questions about the Homestead Tax Credit you may telephone 410-767-2165 in the Baltimore metropolitan area or at 1-866-650-8783 toll free elsewhere in Maryland or email the Homestead unit at sdathomesteadmarylandgov. 3 min read Aug 30 2022 Calendar.

Contact the Harris County Appraisal District at 713-957-7800. Lender Certification for Tax Exempt Bonds and 4 Tax Credit Transactions. The Targeted Jobs Tax Credit which would form the basis of the WOTC became law in 1978.

All units receiving tax credit assistance must have 20 or more households earning no more than 50 of area median income or 40 or more households earning no more than 60 of the area median income.

Credit Reference Form Template Awesome Business Credit Reference Template Free Printable Documents Job Application Template Templates Printable Free Templates

Yale Law Journal Perceptions Of Taxing And Spending A Survey Experiment

U S Research And Development Tax Credit The Cpa Journal

70 Free Employee Surveys Questions Examples Jotform

Work Opportunity Tax Credit What Is Wotc Adp

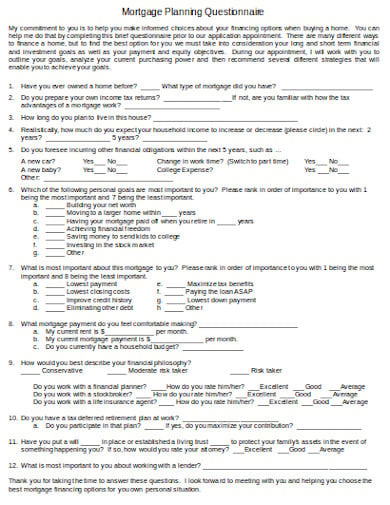

10 Financial Planning Questionnaire Templates In Ms Word Pdf Free Premium Templates

Real Estate Survey Form Template Jotform

Summer Camp Surveys Form Templates Jotform

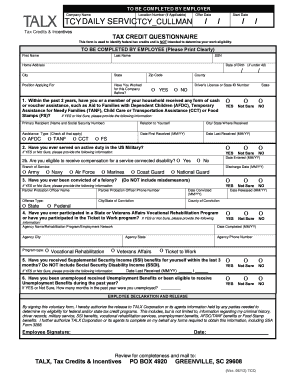

Wotc Form Fill Out And Sign Printable Pdf Template Signnow

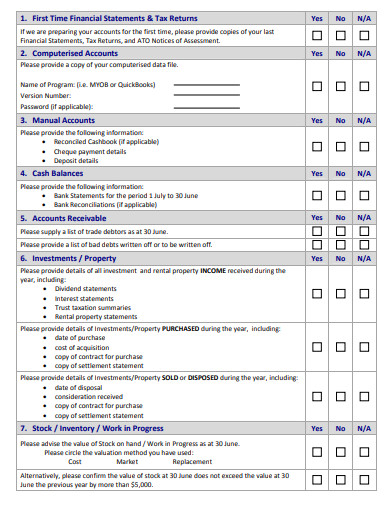

18 Accounting Questionnaire Templates In Pdf Microsoft Word Free Premium Templates

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

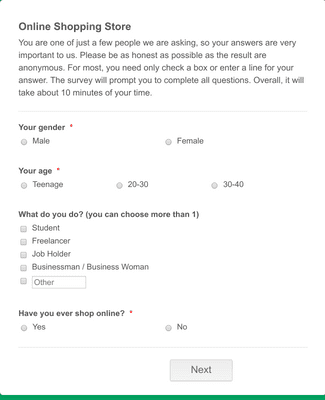

Online Shopping Survey Form Template Jotform

70 Free Satisfaction Survey Templates Jotform

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Parent Satisfaction Survey Form Template Jotform

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopReasonsToBuyEV.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Sample Survey Questionnaire For Cooperative Hauseit Sample Survey Survey Questionnaire Surveys

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/Graphic-6.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels